Day trading the stock market attracts many people because of its fast pace and potential flexibility. The idea of buying and selling stocks within the same day can sound exciting, especially when markets are active and news-driven. However, day trading is not as simple as clicking buy and sell buttons. It requires preparation, discipline, and a realistic understanding of risk.

This article explains practical and responsible tips for day trading the stock market. It is designed for educational purposes and focuses on strategy, mindset, and risk awareness rather than hype or unrealistic expectations.

Understanding What Day Trading Really Is

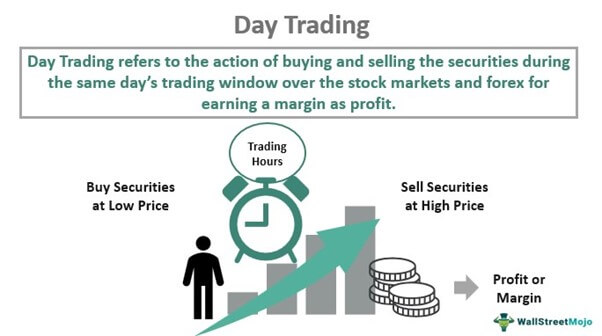

Day trading involves opening and closing stock positions within the same trading day. The goal is to take advantage of short-term price movements rather than long-term growth.

Key Characteristics of Day Trading

- Positions are not held overnight

- Trades are based on intraday price movements

- Decisions are often driven by technical analysis and market behavior

- Risk management plays a critical role

Day trading is different from investing or swing trading, and it requires a different mindset.

Know the Risks Before You Start

One of the most important tips for day trading is understanding the risks involved.

Why Day Trading Is Risky

- Prices can move quickly and unexpectedly

- Emotional decisions can lead to losses

- Transaction costs can add up

- Not every day offers good trading opportunities

Many beginners underestimate how challenging day trading can be. Treating it like a business, not a game, is essential.

Start With Education, Not Real Money

Before risking capital, spend time learning.

Learn the Basics First

Understanding concepts such as:

- Bid and ask prices

- Volume

- Liquidity

- Market orders vs limit orders

These fundamentals help prevent costly beginner mistakes.

Use Paper Trading

Paper trading allows you to simulate trades without real money. It helps you:

- Practice strategies

- Understand platform tools

- Track decision-making without pressure

This step builds confidence and discipline.

Choose the Right Stocks for Day Trading

Not all stocks are suitable for day trading.

Look for Liquidity

Highly liquid stocks:

- Have high trading volume

- Allow easy entry and exit

- Reduce the risk of large price gaps

Focus on Volatility

Day traders often prefer stocks that move enough during the day to create opportunities, but not so much that they become unpredictable.

Pay Attention to Market Timing

Timing matters in day trading.

Best Times for Day Trading

- Market open: Often high volatility and volume

- Midday: Usually slower and less predictable

- Market close: Increased activity as traders close positions

Many experienced traders focus on specific time windows instead of trading all day.

Have a Clear Trading Plan

Trading without a plan is one of the fastest ways to lose consistency.

What a Trading Plan Includes

- Entry criteria

- Exit strategy

- Maximum risk per trade

- Daily profit and loss limits

A plan removes emotion from decision-making and provides structure.

Risk Management Is More Important Than Profits

Successful day trading is less about big wins and more about controlling losses.

Use Stop-Loss Orders

A stop-loss helps limit potential losses if a trade moves against you.

Risk Only a Small Percentage Per Trade

Many traders risk only a small portion of their capital on each trade. This approach helps survive losing streaks.

Control Your Emotions

Emotional discipline is one of the hardest skills to develop.

Common Emotional Traps

- Fear of missing out

- Overtrading after losses

- Holding losing trades too long

- Taking profits too early

Recognizing these patterns is the first step toward improving behavior.

Avoid Overtrading

More trades do not mean better results.

Why Overtrading Is Dangerous

- Increases transaction costs

- Leads to fatigue and poor decisions

- Often driven by emotion rather than strategy

Quality setups matter more than quantity.

Keep a Trading Journal

A trading journal helps you learn from experience.

What to Record

- Entry and exit points

- Reason for the trade

- Market conditions

- Emotional state

Reviewing your journal can reveal strengths, weaknesses, and patterns over time.

Understand the Role of Technical Analysis

Many day traders rely on technical analysis.

Common Tools Used by Day Traders

- Support and resistance levels

- Moving averages

- Volume indicators

- Price patterns

These tools help traders make structured decisions, but no indicator is perfect.

Be Careful With Leverage

Leverage can amplify both gains and losses.

Why Leverage Requires Caution

- Small price movements can cause large losses

- Margin calls can force positions to close

- Emotional pressure increases

Using leverage responsibly is critical, especially for beginners.

Accept That Losses Are Part of Trading

No trader wins every trade.

The Importance of Acceptance

Losses are not failures; they are part of the process. What matters is:

- Keeping losses manageable

- Following your plan

- Learning from mistakes

Consistency matters more than perfection.

Focus on Process, Not Daily Results

Daily profits or losses do not define long-term success.

Think in Terms of Probabilities

Day trading is about executing a strategy consistently over time, not predicting every market move.

Avoid Following Hype and Social Media Tips

Online hype can be misleading.

Why Independent Thinking Matters

- Market conditions change quickly

- Strategies may not suit your style

- Blindly following tips increases risk

Develop your own approach based on education and testing.

Choose a Reliable Trading Platform

Your trading platform matters.

Features to Look For

- Fast execution

- Clear charts and tools

- Transparent fees

- Reliable customer support

A stable platform reduces technical stress during active trading.

Understand Trading Costs

Fees can impact performance.

Common Trading Costs

- Commissions

- Spreads

- Platform fees

Even small costs can add up with frequent trading.

Take Breaks and Protect Your Health

Day trading requires focus.

Why Breaks Are Important

- Reduce mental fatigue

- Improve decision quality

- Prevent burnout

A clear mind leads to better trading decisions.

Set Realistic Expectations

Day trading is not a guaranteed income source.

What Realistic Expectations Look Like

- Slow and steady learning curve

- Inconsistent results early on

- Continuous improvement over time

Patience is essential.

Know When Not to Trade

Sometimes the best trade is no trade.

Situations to Avoid Trading

- Low-volume days

- Unclear market direction

- Strong emotional stress

Waiting for better conditions is part of discipline.

Review and Improve Regularly

Markets evolve, and strategies should too.

Continuous Improvement

Regular review helps you:

- Adjust strategies

- Improve risk management

- Adapt to changing conditions

Learning never stops in trading.

Is Day Trading Right for Everyone?

Day trading is not suitable for all personalities or financial situations.

Who May Be Better Suited

- Disciplined individuals

- Those comfortable with risk

- Traders who enjoy analysis and structure

Who Should Be Cautious

- People seeking quick income

- Those uncomfortable with losses

- Traders without time to learn

Honest self-evaluation is important.

Final Thoughts

Day trading the stock market requires more than enthusiasm. It demands education, discipline, emotional control, and respect for risk. While short-term opportunities exist, long-term survival depends on preparation and realistic expectations.

The most successful traders focus on process, manage risk carefully, and continuously learn from experience. By approaching day trading responsibly and patiently, traders can improve their skills while protecting their capital.

Day trading is a journey, not a shortcut. Those who treat it seriously are more likely to develop consistency over time.

Summary:

Day trading the stock market involves the rapid buying and selling of stocks on a day-to-day basis. This technique is used to secure quick profits from the constant changes in stock values, minute to minute, second to second. It is rare that a day trader will remain in a trade over the course of a night into the next day. These trades are entered and exited in a matter of minutes.

Keywords:

day trading, day trader, trading,trading

Article Body:

Day trading the stock market involves the rapid buying and selling of stocks on a day-to-day basis. This technique is used to secure quick profits from the constant changes in stock values, minute to minute, second to second. It is rare that a day trader will remain in a trade over the course of a night into the next day. These trades are entered and exited in a matter of minutes.

The main question that most people ask when it comes to day trading is simple: �is it necessary to sit at a computer watching the markets ALL day long in order to be a successful day trader?�

The answer is no. It�s not necessary to sit at a computer all day long. There are a number of factors to consider, but generally the rule of day trading is to trade when everyone else is trading. In other words, trade in the morning.

As with all financial investments, day trading is risky � in fact, it�s one of the riskiest forms of trading out there. The stock prices rise or fall according to the behaviour of the market, which is entirely unpredictable. Day traders buy and sell shares rapidly in the hopes of gaining profits within the minutes and seconds they own those particular stocks. Simple to do in theory, harder to do in practice.

If you are constrained by a small amount of capital, you may not be able to buy large amounts of a stock, but buying only a small amount can add to the risk of a loss. And, obviously, it is impossible to predict with certainty which stocks will result in profits and which in losses. Even the best of traders must learn to accept both outcomes.

It�s also important to know that in day trading, it is the number of shares rather than the value of shares that should be the focus. If you day trade, you WILL face losses, but even for the more expensive stocks, the loss should be marginal, because prices do not usually fluctuate to an extreme degree over the course of just one day.

The day trading industry deals in a large variety of stocks and shares. Here are just a few:

Growth-Buying Shares � shares made from profit, which continue to grow in value. Eventually, these shares will begin to decline in price, and an experienced trader can usually predict the future of this type of share.

Small Caps � shares of companies which are on the rise and show no signs of stopping. Although these shares are generally cheap, they are a very risky investment for day traders. You�d be safer to go with large caps and/or mid-caps, which are much more secure and stable thanks to a premium.

Unloved Stocks � company stock that has not performed well in the past. Traders buy these shares in the hopes of generating profits if and when the stock rises in value. As with small caps, unloved stocks can be a risky choice for day traders.

These examples are NOT your only options when it comes to day trading stocks. The best way to determine which type of stock is right for you is to invest some time for careful research, a knowledge of market patterns, a solid strategy, and a disciplined trading plan.

The key to successful day trading is to be prepared. Know as much as possible about the industry before you begin actually trading. You need to learn to trade ONLY when the market gives the right signals, and ONLY when the volume of activity in the market supports a successful trading opportunity.

Leave a Reply